Struggling to buy your first home? Discover the surprising states where Millennials and Gen Z can actually afford to own property—without drowning in debt or living with parents forever.

Introduction

The dream of homeownership has become increasingly elusive for younger generations. Millennials and Gen Z, in particular, face a myriad of challenges that hinder their ability to purchase homes. From staggering student loan debts to skyrocketing home prices and a competitive job market, the path to owning a home is fraught with obstacles. Understanding where young buyers can afford homes is crucial in addressing these challenges and providing viable solutions.

The Current State of Young Homeownership

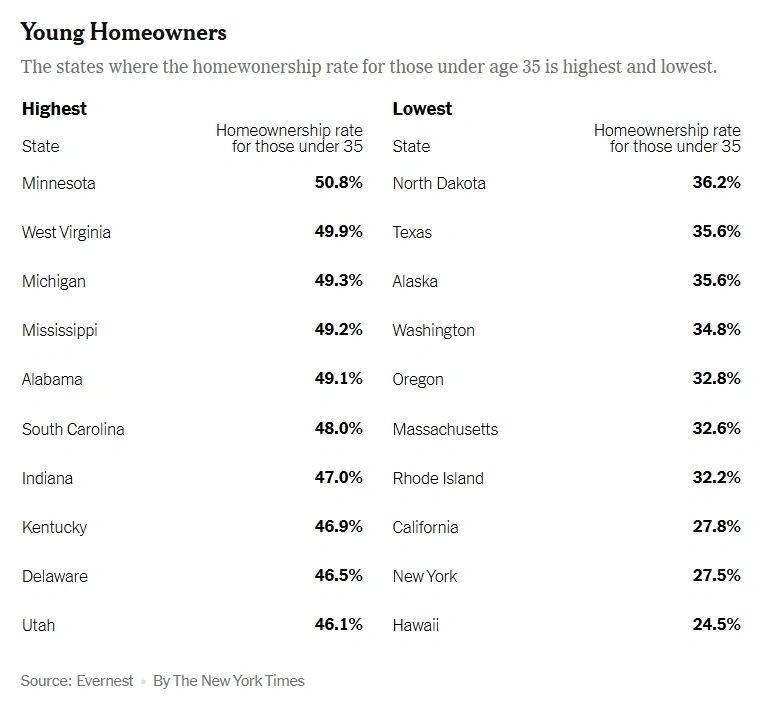

Nationally, the homeownership rate among individuals under 35 is alarmingly low. According to recent data, less than half of this demographic owns a home, with significant variations across states. Several factors contribute to this trend, including economic hardships, high debt levels, and limited access to affordable housing.

Economic Challenges

One of the most significant barriers to homeownership for young adults is the burden of student loan debt. Many Millennials and Gen Z individuals graduate with substantial debt, which hampers their ability to save for a down payment or qualify for a mortgage. Additionally, wage stagnation has made it difficult for young workers to accumulate the necessary funds for home purchases, further exacerbating the issue.

Housing Market Dynamics

The housing market itself presents challenges for prospective young homeowners. Home prices have been on a steady rise, outpacing income growth and making it difficult for first-time buyers to enter the market. Low inventory levels mean that competition for available homes is fierce, often leading to bidding wars that drive prices even higher. Moreover, fluctuating mortgage interest rates can significantly impact affordability, with higher rates increasing monthly payments and overall loan costs.

States with the Highest Young Homeownership Rates

Despite these challenges, some states have managed to maintain higher homeownership rates among young adults, thanks to a combination of affordable housing, favorable economic conditions, and supportive policies.

Minnesota

Minnesota leads the nation with a homeownership rate of 50.8% among individuals under 35. This impressive figure can be attributed to a balanced ratio of median income to home prices. Young adults in Minnesota earn nearly $95,000 annually, while the average home sale price is approximately $323,000. This favorable economic environment makes homeownership more attainable for younger buyers.

Alabama

Ranked as the third-best state for young people to buy property, Alabama boasts a homeownership rate of 49.1% among those under 35. The average house price in the state is $222,500, significantly lower than the national median. Additionally, the average income for young adults aged 25-44 is around $65,600 per year, providing a solid foundation for homeownership.

West Virginia, Mississippi, and Kentucky

These states offer some of the most affordable housing markets in the country, with average home sale prices below $225,000. While young-adult salaries in these states average below $70,000, the lower cost of living and housing prices make homeownership more accessible for younger buyers.

States with the Lowest Young Homeownership Rates

Conversely, certain states present significant challenges for young adults seeking to purchase homes, primarily due to high living costs and limited affordable housing options.

Hawaii and California

Hawaii has the highest percentage of young adults living with their families, at 28.1%, largely due to exorbitant housing costs. The median home list price in Hawaii is $850,000, making it one of the most expensive states for homebuyers. Similarly, California’s high cost of living and median home list price of $730,000 contribute to a low homeownership rate among young adults.

New York and New Jersey

In New York, 23.4% of young adults live with their parents, while in New Jersey, the figure is 25.9%. These high percentages reflect the economic barriers to homeownership in these states, where median home list prices are $652,520 and $536,875, respectively.

The Midwest Advantage

The Midwest stands out as a region where young adults have better opportunities for homeownership, thanks to lower housing costs and favorable economic conditions.

Iowa and North Dakota

Iowa leads the nation with 11.9% of home purchase loans from adults under 25, while North Dakota follows closely with 10.2%. These states offer low house price-to-income ratios, making it easier for young buyers to afford homes.

Indiana and Ohio

Indiana and Ohio also present attractive options for young homebuyers, with home purchase loan shares of 9.8% and 8.5%, respectively. Affordable housing markets and supportive economic conditions contribute to higher homeownership rates among young adults in these states.

Urban vs. Rural: Where Are Young Buyers Settling?

Young buyers are increasingly considering both urban and rural areas for home purchases. Urban areas offer access to employment opportunities and amenities, while rural areas provide more affordable housing options. The rise of remote work has further influenced this trend, allowing young adults to live in more affordable regions without sacrificing job prospects.

The Role of Education and Employment Opportunities

Access to education and employment opportunities significantly impacts young homeownership rates. College towns, in particular, have higher percentages of young homeowners due to the presence of universities and job opportunities.

Provo, Utah and Bloomington, Indiana

Provo, Utah, tops the list with 38.8% of homeowners under 25, followed by Bloomington, Indiana, at 32.5%. Both cities are home to major universities, which attract young adults and provide employment opportunities, contributing to higher homeownership rates.

Financial Assistance and Alternative Financing

Many young buyers receive assistance from family members through gifts or loans for down payments and closing costs. Additionally, innovative mortgage products, such as adjustable-rate mortgages and mortgage points, are helping young adults lower their interest rates and monthly payments, making homeownership more attainable.

Future Outlook for Young Homebuyers

While challenges persist, the future outlook for young homebuyers is cautiously optimistic. Continued efforts to increase affordable housing, provide financial education, and offer supportive policies can help improve homeownership rates among Millennials and Gen Z. As the housing market evolves, young adults must remain informed and proactive in navigating the path to homeownership.

Conclusion

The journey to homeownership for young adults is complex, influenced by economic factors, housing market dynamics, and regional variations. By understanding the challenges and opportunities across different states, young buyers can make informed decisions and take strategic steps toward achieving their homeownership goals.

FAQs

Where Can Younger Buyers Afford Homes in the U.S.?

- Younger buyers, particularly Millennials and Gen Z, can afford homes in states where housing prices are lower and incomes are relatively stable. Top affordable states include Minnesota, Alabama, West Virginia, and Kentucky, where the average home price ranges from $220,000 to $323,000. These areas also offer a favorable house price-to-income ratio, allowing under-35 buyers to achieve homeownership at higher rates than the national average.

What are the main barriers to homeownership for young adults?

- High student loan debt, rising home prices, low inventory, and wage stagnation are significant barriers.

Which states offer the best opportunities for young homebuyers?

- States like Minnesota, Alabama, and Iowa provide favorable conditions with affordable housing and supportive economic environments.

How does student loan debt impact the ability to buy a home?

- Student loan debt reduces the ability to save for a down payment and can affect mortgage qualification.

Are there specific programs to assist young first-time homebuyers?

- Yes, various federal and state programs offer down payment assistance and favorable mortgage terms for first-time buyers.

What trends are emerging in young adult homeownership?

- Increased interest in affordable regions, utilization of alternative financing options, and a focus on financial education are notable trends.

Affordable housing for young buyers Millennial homeownership rates Gen Z home buying trends States with high young homeownership Challenges for first-time homebuyers Student loan impact on home buying Midwest housing affordability Urban vs. rural homeownership Financial assistance for young homebuyers Future of young adult homeownership #AffordableHousing #MillennialHomeownership #GenZHomeBuying #FirstTimeHomebuyers #HousingMarketTrends #StudentLoanDebt #MidwestLiving #UrbanVsRural #HomeBuyingAssistance #FutureHomeowners affordable homes for Millennials, best states for Gen Z to buy a house, homeownership trends under 35, low-cost housing markets USA, top states for young homebuyers 2025, housing affordability for young adults, Millennial housing crisis solutions, first-time homebuyer tips Gen Z, cheap homes for young professionals, housing markets with low price-to-income ratio, student debt and buying a home, and best places to live for young adults in America. These targeted keywords ensure visibility for anyone searching “Where can Millennials afford homes?”, “Cheap states for first-time buyers”, “How Gen Z can buy property”, “Young adult homeownership statistics”, or “Affordable US cities for young buyers.” Strategic SEO tags like #AffordableHousing, #GenZHomeBuying, #MillennialHomeowners, #HomeAffordability2025, and #FirstTimeBuyersUSA