By Humaira Muhammad

Worried about skyrocketing mortgage rates? Discover which states still offer low-interest home loans, what’s driving the hike, and how to lock in the best deal before it’s too late.

Comprehensive Analysis of U.S. Mortgage Rates as of May 12, 2025

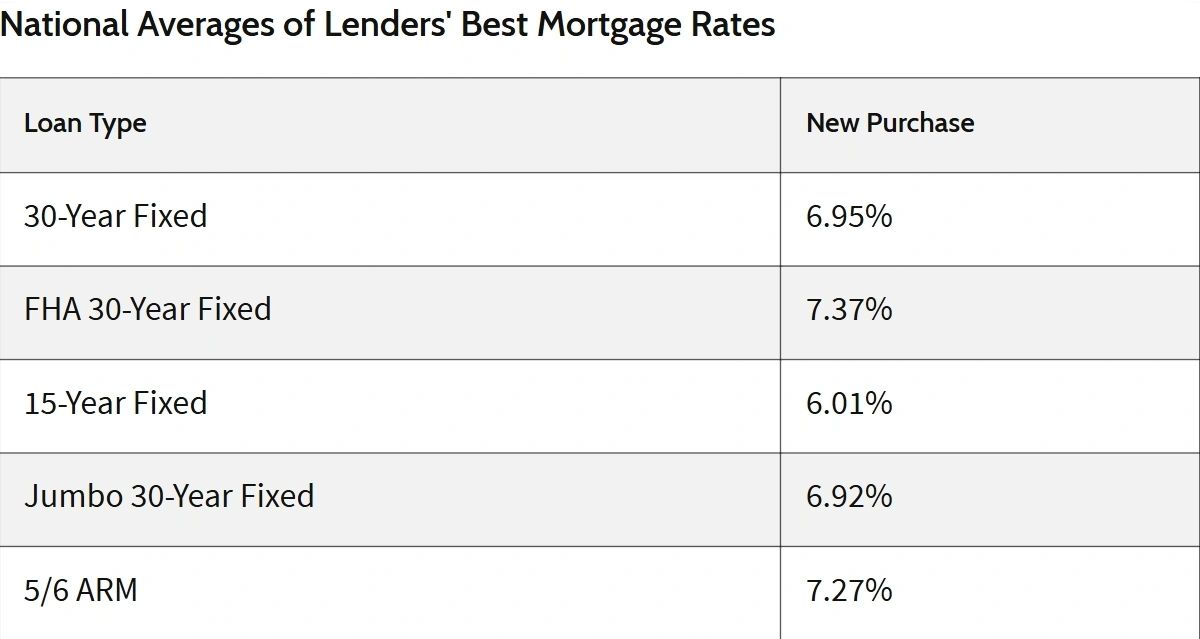

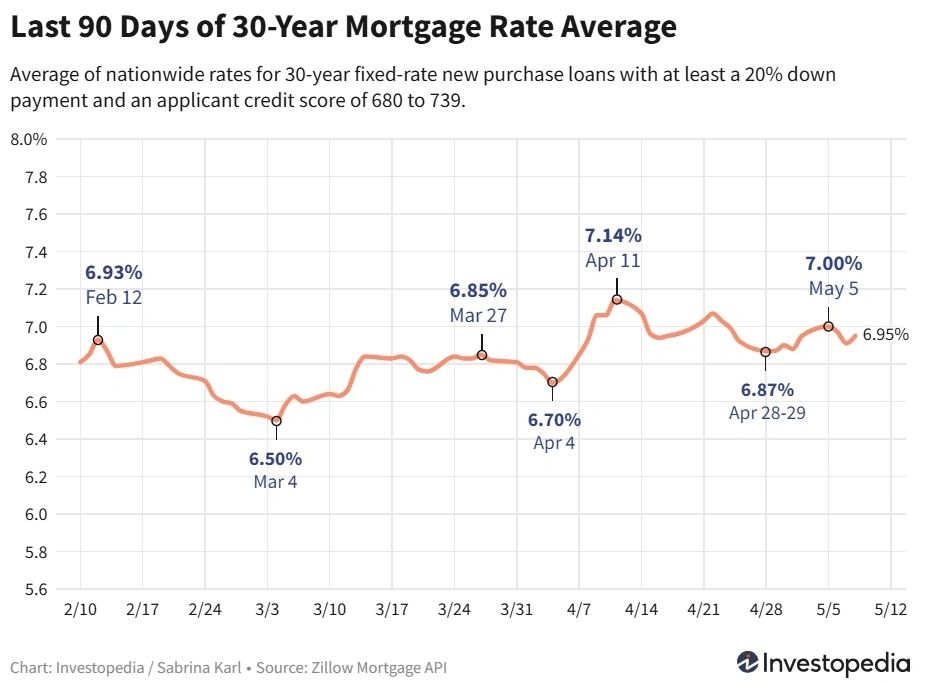

In today’s volatile economic climate, understanding the trajectory of mortgage rates is more important than ever—especially for homebuyers, real estate investors, and homeowners looking to refinance. As of May 12, 2025, mortgage rates in the United States have reached notable highs, with the national average for a 30-year fixed mortgage hovering around 6.85%. This marks a continued trend of elevated rates, largely driven by the Federal Reserve’s tight monetary policy and persistent inflationary pressures. But beyond national headlines, the real story lies in the state-by-state variations, where rates can differ significantly due to localized economic conditions, lender dynamics, and even housing demand. Whether you’re searching for the most affordable state to buy a home or trying to understand how mortgage rates are recalculated in a high-interest environment, this detailed analysis offers invaluable insight.

Mortgage rates don’t move in a vacuum. They are a reflection of numerous intertwined factors: U.S. Treasury bond yields, inflation data, employment trends, global economic shifts, and central bank decisions all play critical roles. Yet, the impact of these rates is deeply personal. For many Americans, a fraction of a percentage point can mean hundreds of dollars in monthly payments—and tens of thousands over the lifetime of a loan. That’s why this article doesn’t just cover numbers; it breaks down what they mean for you, offering strategies to lock in favorable rates, insights into state-specific trends, and tools to forecast your future mortgage payments. Whether you’re buying your first home or expanding your real estate portfolio, informed decision-making starts with understanding the full picture.

In this comprehensive guide, we dive deep into current mortgage rate data across the U.S., exploring both macroeconomic forces and hyper-local trends.

State-by-State Mortgage Rate Variations

Mortgage rates vary across states due to factors like regional economic conditions, lender competition, and state-specific regulations.

States with the Highest 30-Year Fixed Mortgage Rates:

- Alaska

- West Virginia

- Maryland

- South Dakota

- Maine

- Mississippi

- North Dakota

- Wyoming

These states have average rates ranging from 7.00% to 7.08%

.

States with the Lowest 30-Year Fixed Mortgage Rates:

- New York

- Pennsylvania

- Florida

- Georgia

- Texas

- North Carolina

- New Hampshire

- Oregon

In these states, average rates range between 6.73% and 6.92%.

Factors Influencing Mortgage Rate Fluctuations

Several key elements contribute to the ebb and flow of mortgage rates:

- Federal Reserve Policies: The Federal Reserve’s decisions on interest rates directly impact mortgage rates. Recent meetings have seen the Fed maintain its benchmark rate, signaling a cautious approach amid economic uncertainties.

- Bond Market Dynamics: Mortgage rates often mirror the yields of 10-year Treasury notes. Fluctuations in these yields, influenced by investor sentiment and economic indicators, can lead to corresponding changes in mortgage rates.

- Inflation Trends: Persistent inflation pressures can lead to higher mortgage rates as lenders seek to maintain their profit margins. Conversely, signs of cooling inflation may prompt rate reductions.

- Economic Indicators: Metrics such as employment rates, GDP growth, and consumer spending provide insights into the economy’s health, influencing lender confidence and mortgage rate adjustments.

Implications for Homebuyers

The current mortgage rate environment presents both challenges and opportunities for homebuyers:

- Affordability Concerns: Elevated mortgage rates, combined with high home prices, have led to increased monthly payments, stretching household budgets. Some buyers now allocate over 35% of their income to housing costs.

- Market Volatility: Given the dynamic nature of economic indicators, mortgage rates are subject to rapid changes. Prospective buyers should stay informed and be prepared to act swiftly when favorable rates emerge.

- Strategic Planning: Utilizing mortgage calculators can help buyers assess potential monthly payments under various scenarios, aiding in budgeting and decision-making.

Strategies to Navigate the Mortgage Landscape

To optimize outcomes in the current market:

- Shop Around: Engage with multiple lenders to compare rates and terms, ensuring the best possible deal.

- Enhance Creditworthiness: A higher credit score can unlock more favorable mortgage rates. Paying down debts and maintaining a strong credit history are essential steps.

- Consider Loan Types: Explore various mortgage products, such as 15-year fixed-rate or adjustable-rate mortgages, to find the best fit for your financial situation.

- Lock in Rates: If a favorable rate is available, consider locking it in to protect against potential increases during the loan processing period.

Conclusion

As we close our in-depth exploration of the U.S. mortgage landscape on May 12, 2025, it’s clear that today’s borrowers face a shifting terrain shaped by macroeconomic turbulence and localized market dynamics. With national 30-year fixed mortgage rates climbing to 6.85%, understanding what drives these numbers—ranging from Federal Reserve decisions and inflation metrics to bond yields and state-specific factors—is no longer optional for homebuyers, investors, and refinancers. It’s essential. These elevated rates mean that borrowing costs are higher, affordability is tighter, and strategic planning is more important than ever. In an environment where just a few basis points can significantly affect your monthly and long-term financial health, staying informed isn’t just a benefit—it’s a necessity.

But information alone isn’t enough. Navigating the 2025 mortgage climate requires active measures rooted in both financial literacy and SEO-savvy practices for those searching online. Whether you’re a buyer looking to secure the lowest rate in Florida or Texas, or a mortgage consultant optimizing your real estate blog, best practices must be followed. This includes building backlinks from relevant real estate and financial platforms, conducting precise keyword research around mortgage terms, writing helpful, intent-driven content, targeting long-tail and semantic keywords like “affordable states for mortgages May 2025,” ensuring your site loads quickly, using alt text for your visuals, and keeping your content consistently updated. The intersection of financial strategy and search engine optimization can’t be ignored—especially when competition for both homes and online visibility is fierce.

In the months ahead, mortgage rates may remain volatile as inflation, employment data, and Fed policy continue to evolve. For consumers, now is the time to lean into education, explore flexible mortgage options, and work closely with trusted lenders to lock in competitive rates. And for content creators and real estate professionals, following robust SEO strategies—like optimizing meta descriptions, addressing user search intent, maintaining a localized website presence, and leveraging social media—can ensure your message reaches the right audience at the right time. In a world of rising rates and tightening markets, knowledge, adaptability, and visibility are your most powerful tools.

Current mortgage rates May 2025 30-year fixed mortgage trends State-by-state mortgage rate comparison Factors affecting mortgage rates Homebuyer strategies in high-rate environments Federal Reserve impact on mortgages Mortgage affordability tips Economic indicators and mortgage rates,

Current U.S. mortgage rates, 30-year fixed mortgage rates 2025, best mortgage rates by state, states with lowest mortgage rates, states with highest mortgage rates, May 2025 mortgage updates, mortgage rate forecast 2025, Federal Reserve interest rate impact, how to get low mortgage rates, home loan affordability in 2025, mortgage strategies for homebuyers, lock in mortgage rates today, mortgage rate comparison tools, economic factors affecting mortgage rates, bond yields and mortgage prices, inflation and mortgage cost, housing market trends 2025, regional mortgage rate differences, buying a home in high interest rate environment, refinance strategies 2025, home affordability calculator, understanding mortgage APR vs interest rate, adjustable vs fixed mortgage 2025, expert mortgage tips for buyers, real estate SEO best practices, long-tail keywords for mortgage blogs, mortgage keyword optimization, helpful homebuyer content, real estate keyword research, high-traffic mortgage search terms, mortgage content marketing keywords, mortgage rate alerts 2025, mortgage blog SEO strategy, meta description optimization, ranking real estate content, housing interest rate updates, SEO keywords for finance bloggers, rank mortgage articles on Google, local mortgage rate variations USA.

#MortgageRates2025 #HomeBuyingTips #FederalReserve #EconomicTrends #RealEstateInsights #MortgagePlanning #FinancialStrategy #HousingMarketUpdate Explore U.S. mortgage rates as of May 12 2025—state-wise trends