By Humaira Muhammad

Wondering if now’s the right time to buy, sell, or invest in real estate? This deep dive into the 2025–2029 U.S. housing market reveals game-changing mortgage trends, policy shifts, and what they really mean for your wallet.

The U.S. housing market stands on the brink of a pivotal transformation from 2025 through 2029—shaped by a complex interplay of elevated mortgage rates, constrained housing inventory, and sweeping real estate policy reforms. As prospective homebuyers wrestle with affordability concerns, investors seek long-term clarity, and industry stakeholders navigate evolving regulations, the next five years promise both challenges and strategic opportunities. Mortgage interest rates—hovering above 6%—remain a central driver in cooling demand, while inventory shortages continue to exacerbate price pressures and hinder mobility. Simultaneously, seismic policy changes, including the ban on MLS commission sharing and the rise of buyer-broker agreements, are disrupting traditional transaction models, forcing both agents and clients to adapt.

Beneath the headlines, however, deeper forces are at work. From new construction trends and rental market fluctuations to surging homeownership costs and persistent housing shortages, the broader landscape reveals an uneven recovery marked by regional disparities, demographic shifts, and labor constraints. With home insurance premiums spiking, Homeowners Association (HOA) fees escalating, and climate-related adaptations raising the cost of maintenance, the true cost of homeownership has never been higher. This report takes a data-driven, multi-perspective approach—blending insights from Realtor.com, Redfin, the National Association of Realtors (NAR), and MarketWatch—to deliver an in-depth, forward-looking analysis. Whether you’re a buyer, seller, investor, or policymaker, understanding these nuanced market dynamics is essential for making informed, future-proof decisions.

1. Mortgage Rates: The Pivotal Market Driver

Persistent Elevation in Mortgage Rates

Mortgage rates are anticipated to remain elevated, with projections indicating averages above 6% through 2025. Realtor.com’s economic research forecasts an average rate of 6.3% for 2025, slightly decreasing to 6.2% by year-end. This sustained high rate environment is a departure from the historical average of 4% observed between 2013 and 2019.Realtor

Influence of Economic Indicators

The Federal Reserve’s cautious approach to interest rate adjustments, driven by persistent inflation concerns, suggests that significant reductions in mortgage rates are unlikely in the near term. Redfin economist Chen Zhao notes that the Fed may not implement rate cuts before September 2025, as inflationary pressures, exacerbated by tariffs on Chinese goods, continue to pose challenges. Business Insider

Potential Recessionary Impacts

While a recession could lead to lower mortgage rates, it would also bring about economic drawbacks, including rising unemployment and weakened household finances. Therefore, meaningful relief in mortgage rates is unlikely unless the U.S. experiences a severe economic downturn.Business Insider

2. Existing Home Sales: Gradual Recovery Amid Constraints

Moderate Growth in Sales Volume

Existing home sales are projected to experience moderate growth as buyers acclimate to higher mortgage rates and home prices. Realtor.com anticipates a 1.5% increase in sales of previously owned homes, reaching approximately 4.07 million transactions in 2025. However, this figure remains below the historical average of 5.28 million observed from 2013 to 2019.Realtor

Factors Influencing Buyer Behavior

The decision to purchase homes will increasingly be driven by life events such as job changes, financial shifts, or alterations in household composition. If mortgage rates decline more rapidly, pent-up demand from recent years could be unleashed, potentially returning sales volumes to historic norms.

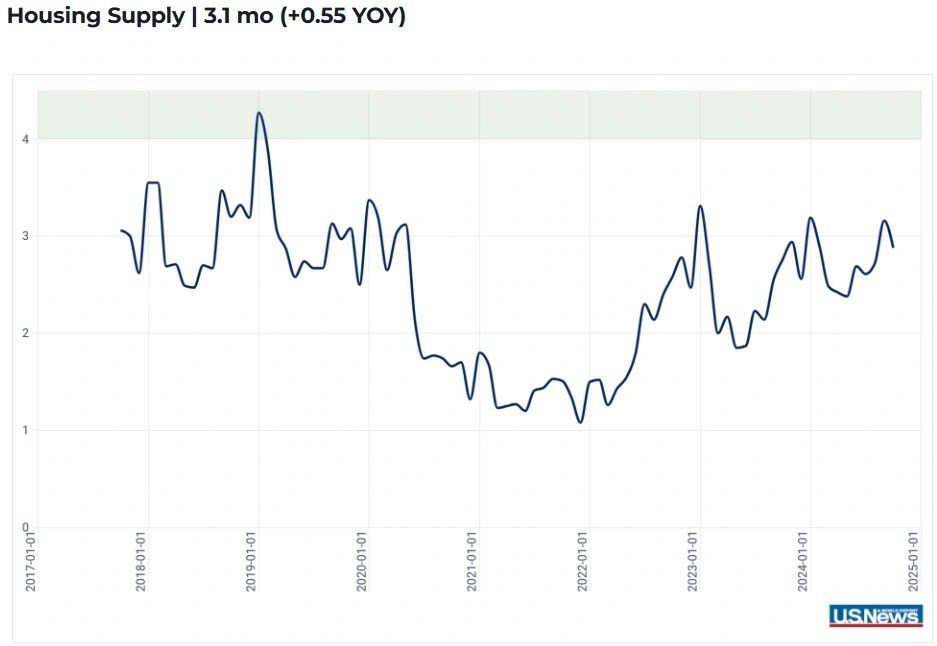

Inventory Challenges

A significant constraint on existing home sales is the limited inventory available. Many homeowners with mortgage rates below 6% are reluctant to sell, leading to a shortage of listings. This “lock-in effect” continues to impact market dynamics, although its influence is gradually diminishing as more homeowners are compelled to sell due to various life circumstances.

3. New Home Construction: Bridging the Supply Gap

Increased Share of New Builds

Newly built homes are playing a crucial role in addressing the supply shortages in the housing market. In recent months, new constructions have accounted for approximately 30% of overall housing inventory, nearly double their historical share. This trend is expected to continue as builders respond to the demand created by the lack of existing home inventory.

Builder Incentives and Strategies

Homebuilders are employing various strategies to attract buyers, including mortgage rate buydowns, covering closing costs, and offering design center allowances. These incentives are particularly appealing to buyers seeking affordability in a high-rate environment. Doug Bauer, CEO of Tri Pointe Homes, expresses optimism about the spring selling season, emphasizing the company’s readiness to meet unmet demand.

Regulatory and Labor Considerations

The construction industry faces challenges related to regulatory requirements and labor shortages. Efforts to reduce energy-efficient building codes mandated by HUD and USDA aim to improve affordability by lowering construction costs. However, ongoing issues with skilled labor availability continue to pose obstacles to increasing housing supply.

4. Real Estate Commission Reforms: A Paradigm Shift

Elimination of MLS Compensation Offers

Effective August 17, 2024, the National Association of Realtors (NAR) implemented significant changes to real estate commission practices. Offers of compensation are now prohibited on Multiple Listing Services (MLSs), requiring buyers and their agents to negotiate compensation directly. commissionsync.com+5Richard Russell Law+5National Association of REALTORS®+5

Mandatory Buyer Representation Agreements

Agents working with buyers must enter into written agreements before touring homes. These agreements outline the services provided and the compensation structure, promoting transparency and allowing buyers to understand the costs associated with representation. House Beautiful+3Richard Russell Law+3National Association of REALTORS®+3

Implications for Buyers and Sellers

The reforms grant buyers more negotiating power and flexibility in choosing services. However, they also introduce complexities, as buyers must now directly negotiate agent fees, and sellers may need to adjust their listing strategies. The changes aim to prevent anti-competitive practices and promote fairness in the real estate market.commissionsync.com

5. Total Cost of Homeownership: Beyond Mortgage Payments

Rising Ancillary Costs

Homeownership expenses extend beyond mortgage payments, encompassing property taxes, insurance, maintenance, and climate adaptation costs. A study by Bankrate in mid-2024 revealed that these annual variable costs for a typical single-family home rose by nearly 26% between March 2020 and March 2024, totaling over $18,000 per year.

Insurance Premium Increases

Surging home insurance costs are impacting housing affordability. In Portland, for instance, insurance accounted for 5.9% of the average mortgage payment in December 2024, up from 4.2% five years earlier. The average monthly insurance payment more than doubled over the past decade, driven by the increasing frequency of natural disasters and rising rebuilding costs. Axios

Homeowners Association (HOA) Fees

An increasing number of residents live in communities governed by HOAs, which impose monthly fees and special assessments. The national average monthly HOA fee is $259, covering various community services. However, poorly managed HOAs can lead to unexpectedly high assessments, underscoring the importance of reviewing governing documents and financial statements before purchasing in such communities.

6. Rental Market Trends: Affordability and Supply Dynamics

Rent Increases and Inflation

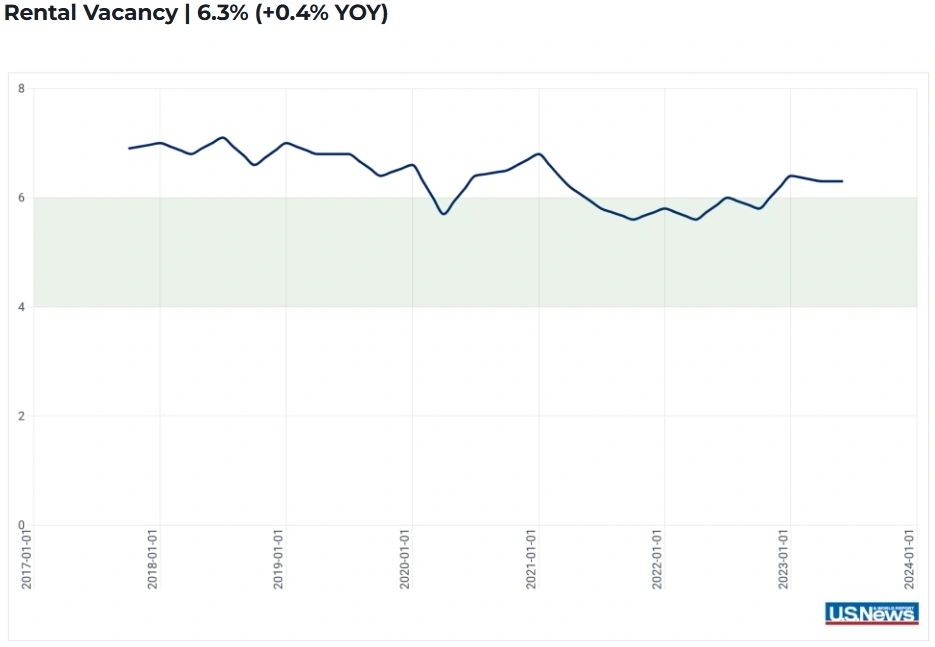

Rising rental costs have been a significant driver of U.S. inflation. In April 2025, shelter expenses contributed to over half of the month’s 0.2% consumer price increase. Over the past five years, average apartment rents rose 29% to $1,900, and single-family home rents surged 43% to $2,300, outpacing the 23% growth in median household income. MarketWatch

Supply and Demand Imbalances

An oversupply of rental units temporarily eased affordability pressures, but economic uncertainty, high construction costs, and reduced builder activity signal a slowdown in new housing supply. This could lead to renewed rent increases, as forecasts for rent growth are being revised upward.MarketWatch

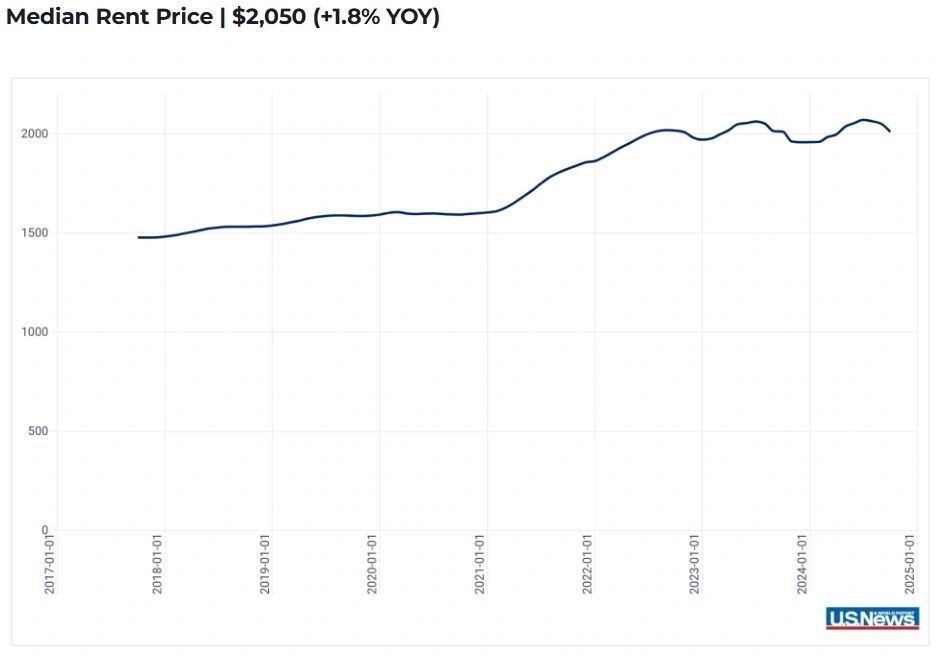

Regional Variations

Rental vacancy rates and median rent prices vary across regions. As of the second quarter of 2024, the rental vacancy rate stood at 6.3%, with a median rent price of $2,050, reflecting a 1.8% year-over-year increase. These figures highlight the ongoing challenges in achieving rental affordability nationwide.

7. Housing Shortage: A Persistent Challenge

Pent-Up Demand

The estimated pent-up demand for housing ranges up to 4.5 million homes. Even with increased new home construction, it will take time to address this shortfall due to constraints in land availability, skilled labor, and materials. The National Association of Home Builders anticipates that this demand will be met between 2025 and 2030.

Demographic Shifts

Changing demographics, including aging populations and varying household formations, will influence housing demand. By 2030, these shifts may result in lower demand for new housing, emphasizing the need for adaptable housing policies and development strategies.

Policy Interventions

Addressing the housing shortage requires collaborative efforts involving government, industry, and community stakeholders. Policies aimed at streamlining permitting processes, incentivizing affordable housing development, and investing in infrastructure are essential to alleviate supply constraints.couriermail.com.au

8. Long-Term Market Predictions (2025–2029)

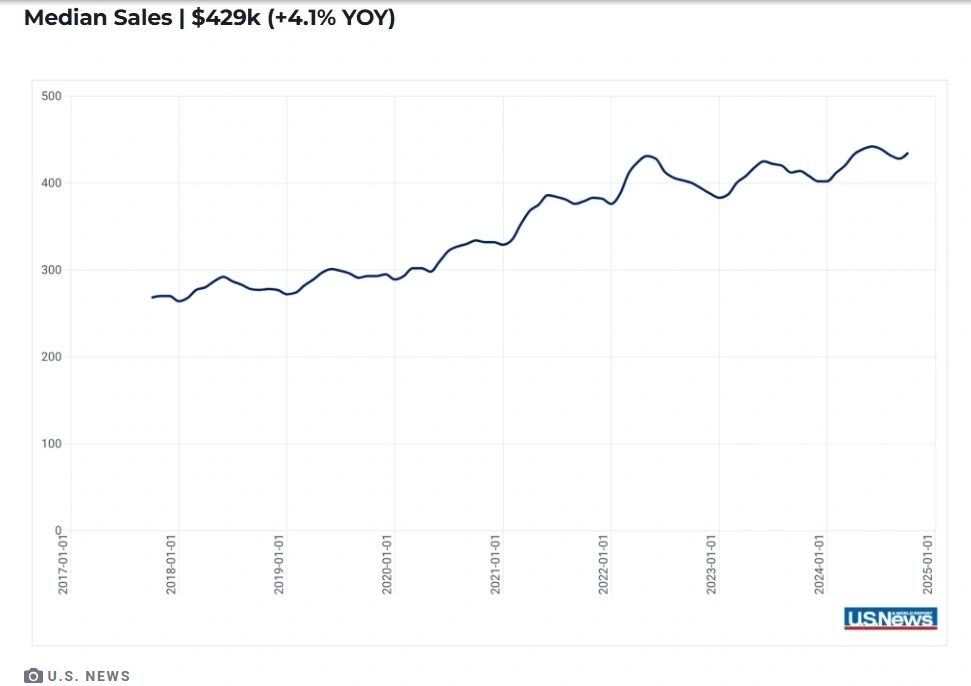

Home Price Trajectory

Home prices are expected to continue rising moderately, with projections indicating a 17% increase from 2024 levels by 2029. This growth reflects a percentage point or so above the rate of inflation, influenced by ongoing supply constraints and demand factors.

Sales Volume Outlook

After experiencing the lowest levels in nearly 30 years during 2023 and 2024, existing home sales are predicted to gradually increase through 2029. New home sales, bolstered by builders’ ability to offer incentives, will expand on gains made in 2024, though they will continue to be limited by competition for buildable land and skilled labor

🔚 Conclusion: Charting a Confident Path Through a Shifting Housing Landscape

As we navigate the complex terrain of the U.S. housing market through 2029, one truth becomes clear: adaptability is the new currency. The real estate landscape is no longer driven solely by interest rates or home prices—it’s shaped by a multifaceted web of economic signals, legislative reforms, demographic transitions, and structural imbalances. Buyers and sellers alike must recalibrate their expectations in the face of persistently high borrowing costs, an evolving rental market, and tightening inventories. Meanwhile, builders, lenders, and policymakers will need to find innovative solutions to bridge the affordability gap and accelerate the pace of new housing development—without compromising quality, sustainability, or access.

The coming years will test the resilience of American real estate, but they will also create openings for strategic decision-making and long-term gains. Those who understand how to leverage shifting market conditions—such as rising insurance costs, changing buyer-agent relationships, and the opportunities in new home construction—will be best positioned to thrive. As the market transitions from a period of volatility into a phase of cautious recovery and recalibration, knowledge, timing, and flexibility will define success. The future of U.S. housing may be uncertain, but for those who stay informed and act decisively, it remains full of opportunity.

U.S. housing market outlook 2025–2029, future mortgage rates in the U.S., housing inventory shortage 2025, real estate market trends USA, real estate policy changes 2025, impact of high mortgage rates on homebuyers, new home construction forecast USA, homeownership cost analysis, real estate commission reform 2024, buyer representation agreements in real estate, affordable housing strategies in 2025, rising rent trends USA, supply-demand imbalance in housing market, regional housing price variations, long-term housing market forecast, investment strategies for U.S. housing, home insurance cost trends, climate impact on housing costs, rent vs. buy decision 2025, first-time homebuyer advice, real estate investor tips 2025, home price prediction 2029, real estate bubble or stable growth, buying a home during high interest rates, MLS commission changes explained, best time to sell property 2025, rising HOA fees trends, labor shortage in construction, housing affordability crisis, housing supply gap solutions, inflation impact on real estate, federal policies affecting housing, Redfin housing outlook, Realtor.com 2025 housing forecast, how to navigate real estate in a volatile economy, top real estate markets 2025–2029, smart home buying strategies 2025, cost of owning a home in USA, real estate trends during inflation, best U.S. cities to buy property 2025, future of rental prices in the U.S., how new laws affect homebuyers and agents, what to expect in the next housing cycle, housing demand vs supply outlook, top mortgage advice for 2025. explore real estate. american real estate.